How to Fill Out and Submit Modelo 303

Modelo 303 Impuesto sobre Valor Añadido (IVA)

A detailed official instruction from Agencia Tributaria explains the rules for each field and the procedure for electronic submission , but unfortunately, without examples, it can be difficult to understand.

This guide visually demonstrates how to fill out and submit Modelo 303 using sample invoices for income and expenses.

Purpose of Modelo 303

The main purpose of this form is to regularly declare the amount of IVA received from your clients and the amount of IVA paid when acquiring goods or services for your business activity. The difference between these amounts is the sum to be paid to the tax authority or to be refunded.

IVA is a consumption tax.

If you provide a service and add IVA to the invoice, the consumer pays you this amount, and you must transfer this amount to the tax authority by submitting Modelo 303.

If you are a consumer and purchase a good or service that is subject to IVA, you pay this amount to the seller, and they must transfer it to the tax authority by submitting Modelo 303.

If you are a business owner and purchase a good or service not for consumption but as a means of production, you have the right to reclaim the paid IVA by submitting Modelo 303 and indicating the operations for refund.

Not all invoices you receive or issue are subject to IVA.

Depending on who your client is and where your supplier is located, you may issue invoices with 0% IVA. This is often because the place of supply of the good or service is another country or territory where the Spanish IVA law does not apply.

Who is required to submit Modelo 303?

Certain types of educational, medical, cultural, and social services, as well as autónomo on some regimes other than the general tax regime, are exempt from submitting Modelo 303. Additionally, entrepreneurs in Canarias, Ceuta, and Melilla do not submit this form.

All others are required to submit this form.

Lack of activity does not cancel the obligation to submit the declaration.

How to submit “zero” declarations - see the article .

When should it be submitted?

Modelo 303 is submitted quarterly (trimestral):

- 1st quarter: by April 20

- 2nd quarter: by July 20

- 3rd quarter: by October 20

- 4th quarter: by January 30 of the following year

In some cases, the declaration is submitted monthly.

Initial Data

Let’s consider submitting the declaration for the first quarter (1T) using the example of an autónomo with the following income and expense structure:

Income (Ingresos):

- Company from Italy, invoices for 2500€ per month. Instead of Italy, it can be any country within the European Union.

- Company from Armenia, invoices for 1500€ per month. Instead of Armenia, it can be the UK, US, RU, or any other country outside the European Union.

| Description | Cost Before VAT | VAT Rate | VAT | Total |

|---|---|---|---|---|

| Company from Italy | 2500€ | 0% | 0€ | 2500€ |

| Company from Armenia | 1500€ | 0% | 0€ | 1500€ |

To issue invoices with 0% IVA for clients outside Spain, located in other EU countries, both you and your client must be registered in El Registro de Operadores Intracomunitarios (ROI) also known as VIES. You can check it here: VIES TAX NUMBER

Expenses (Gastos):

Expenses that can be deducted from the tax base include: equipment and furniture necessary for work, software and services for business activities, as well as internet payments and social security contributions.

Expenses for the first quarter:

| Description | Cost Before VAT | VAT Rate | VAT | Total |

|---|---|---|---|---|

| Internet service | 14.4€ | 21% | 3.02€ | 17.42€ |

| Keyboard for work | 112.38€ | 21% | 23.6€ | 135.98€ |

| Social security contributions | 85.71€ | 0% | 0€ | 85.71€ |

| Chair from IKEA | 66.11€ | 21% | 13.88€ | 79.99€ |

- Internet service provider

- Keyboard for work

- Social security contributions

- Chair from IKEA

Filling out Modelo 303 through the tax office’s website

Example of the Modelo 303 form

There are more fields than in Modelo 130, but filling it out is just as easy. Some fields we will leave blank, or they will be calculated automatically.

Go to the form submission page

Select Modelo 303. Ejercicio 2026. Presentación y servicio de ayuda Pre303

Authenticate using any available method

The form page will open.

Fill in the data

Indicate the period for which the declaration is submitted and the applicant’s details.

Click Enviar

The page with information about the types of activities will open.

Go to the Modelo 303 form

Click Continuar con la Presentación modelo 303 in the top menu

Select Nueva declaración

The form for entering data will open.

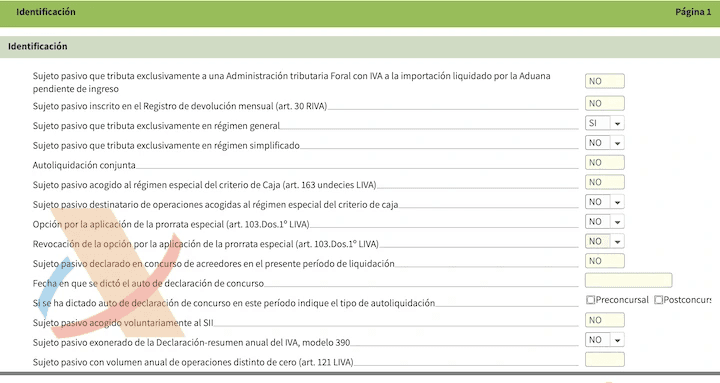

Page 1: Identificación

Indicate NO for Sujeto pasivo destinatario de operaciones acogidas al régimen especial del criterio de caja

The rest of the fields will be filled in automatically.

Navigation between pages is done at the top of the form with blue arrows ◀ 1/4 ▶

Go to page 2.

Page 2: Régimen general

This page consists of two main sections:

- IVA devengado - also called IVA repercutido (output VAT) - this is the VAT that the autónomo receives from their clients when selling goods or providing services. This amount must be transferred to the tax authority.

This section includes information on sales of goods and services with IVA within Spain. Also, operations acquiring goods and services from other EU countries and non-EU countries at a 0% IVA rate . These types of operations are covered in other sections of the guide.

- IVA deducible or IVA soportado (input VAT) - this is the VAT paid to suppliers when purchasing goods or services used for economic activity. This amount is refundable or offset against the amount indicated in the IVA devengado section.

| Description | Cost Before VAT | VAT Rate | VAT | Total |

|---|---|---|---|---|

| Internet service | 14.4€ | 21% | 3.02€ | 17.42€ |

| Keyboard for work | 112.38€ | 21% | 23.6€ | 135.98€ |

| Social security contributions | 85.71€ | 0% | 0€ | 85.71€ |

| Chair from IKEA | 66.11€ | 21% | 13.88€ | 79.99€ |

The expenses from the example relate to current internal operations - Por cuotas soportadas en operaciones interiores corrientes, and should be entered in fields [28] and [29].

Field [28] - this is the sum of all incoming invoices (invoices) subject to IVA and not including IVA (column Base imponible).

Social security contributions are not subject to IVA, so they do not need to be indicated in this declaration.

Internet for three months = 43.2€

Calculation: 43.2€ + 112.38€ + 66.11€ = 221.69€

Field [29] - the sum of IVA on all invoices included in the calculation of field [28]. This is the amount of VAT to be refunded.

IVA Internet for three months = 9.06€

Calculation: 9.06€ + 23.6€ + 13.88€ = 46.55€

If the main residence is used for work, it is possible to reclaim part of the IVA from bills for water, gas, electricity, and internet, as described in the post .

Go to the next page.

Page 3: Información adicional

On this page, fill in fields: [59] and [120]

Field [59] - the sum of outgoing operations with clients within the European Union. The sum of invoices issued to the client from Italy for this quarter

Calculation: 1500 * 3 = 7500€

Field [120] - the sum of outgoing operations with clients outside the European Union. The sum of invoices issued to the client from Armenia (GB, RU, etc.) for this quarter.

Calculation: 2500 * 3 = 4500€

Go to the next page.

Page 4: Resultado

For the first quarter (1T), you can leave everything as it is.

In subsequent quarters, you need to fill in field [110] if the option a compensar was chosen earlier. For example, in the declaration for the second quarter 2T, you need to indicate this field equal to the compensation amount in the first quarter - 46.55€.

The value of field [110] can carry over to the next year if the refund option was not chosen in the fourth quarter.

Validate the form

Click Validar at the top of the page, a message should appear indicating no errors.

If the IVA devengado section is not filled in, the following warning may appear

It can be ignored.

For the declaration for the 4th quarter (4T), the following warnings may appear:

They can also be ignored.

This concludes the main part of the filling process.

Choose the method of refund or compensation of IVA

Click the Presentar declaración button at the top of the page. A window will open where you can choose the method of refund Solicitud de devolución or compensation of IVA A compensar.

What does each of these options mean?

A compensar

If the result of the declaration is negative, then by choosing this option, the amount accumulates and is saved. In subsequent quarterly declarations, this amount of VAT can be offset against the amount of IVA devengado (output VAT). In case the amount of IVA received from clients is greater than the amount to be refunded from the IVA deducible section (input VAT).

For example, in the first quarter, the a compensar option was chosen for the amount of 46.55€. In the next quarter, an invoice was issued to a client from Spain for 1000€ + 210€ IVA. The difference between IVA devengado [27] - IVA deducible [45] = 210 - 0 = 210€. This amount needs to be paid to the tax authority.

Now you can offset this amount with the saved 46.55€. As a result, you will need to pay 163.45€

A devolución

This option is for refunding the amount of VAT to a bank account.

A refund can only be requested in the fourth (4T) quarter

The first three quarters, the declaration is submitted with the A compensar option, and in the fourth quarter, if desired, A devolución is chosen to refund the amount of VAT.

If in the fourth quarter there is neither input nor output VAT, then to request a refund, you need to manually apply the quotas. Click the ✎ edit button next to field [110] and in the window that appears enter the entire amount from field [110] into field [78].

The refund period can take up to 9 months

Submit the completed declaration

Click Firmar y Enviar

Click Continuar

A pop-up window will appear confirming the submission.

Check the Confirme box and click Firmar y Enviar

The next page will show the completed form, which is advisable to download.

The declaration is submitted!

⭐ How to fill out the quarterly income declaration (Modelo 130)

⭐ How to fill out the declaration for intra-EU operations (Modelo 349)

⭐ How to correctly issue an invoice

⭐ How to keep accounting books for autónomo

Any questions or suggestions? channel Españevo: 🇪🇸Autonomo, Taxes